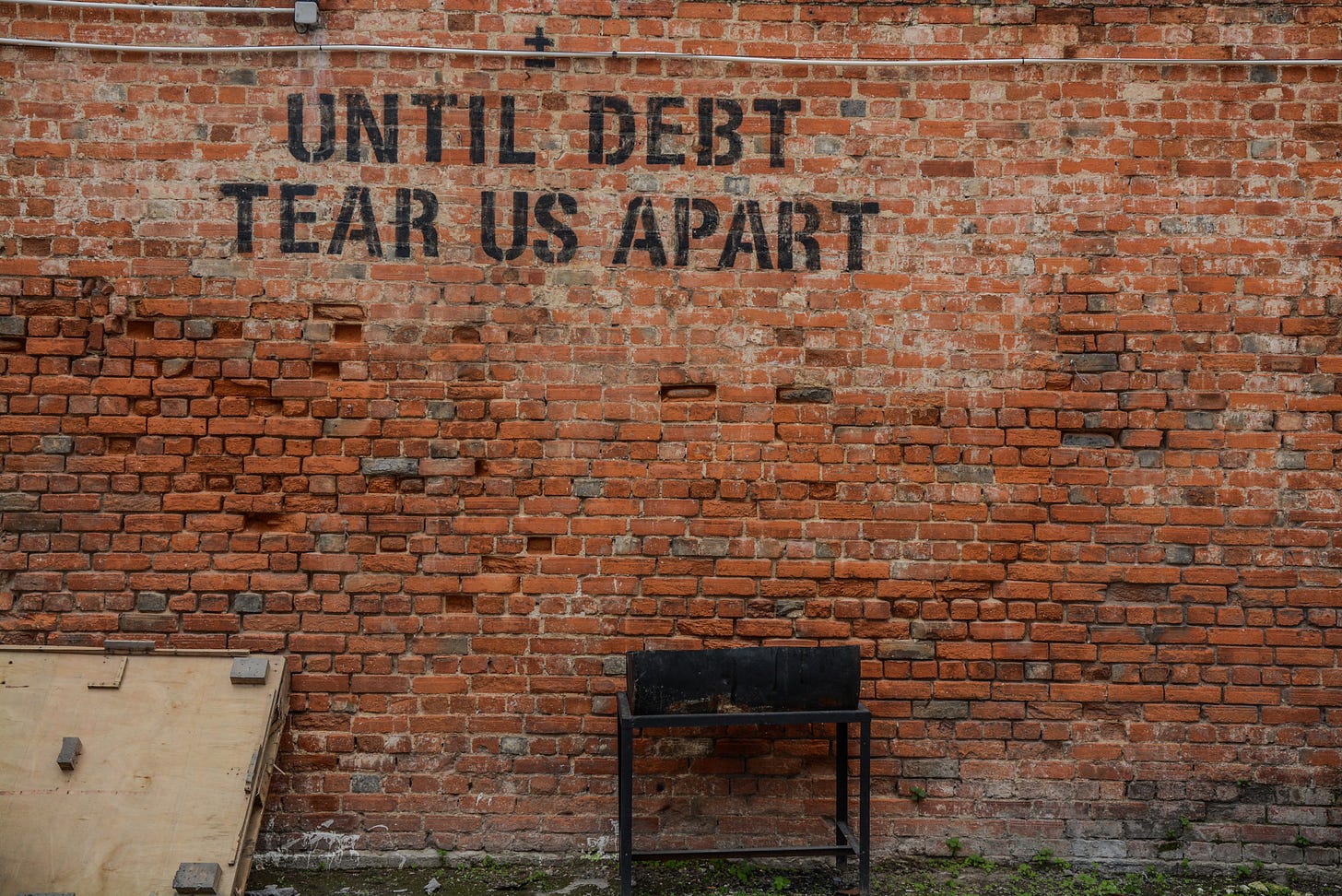

This new study on student loan debt is kinda depressing

One in 10 people surveyed said they still owe money 20 years after graduating college and many who left school without a degree are in the same boat. Plus: A bucket hat that captures my summer vibe.

Now that Congress is on a break until the House returns for a week to vote on the Democrats’ budget plan that makes up the bulk of President Joe Biden’s agenda, I thought It’d be nice to reset our sights on another critical issue of the moment: Student loan debt.

In a new study by education research firm Intelligent, one in 10 people surveyed said they still have student loan debt 20 years later. And three in four individuals who have been out of school six to 10 years, and left school without completing a degree, say they’re still paying off their loans.

Besides the financial toll, student loan debt chips away at borrowers’ well-being too. “I think that there’s no argument that obviously, many people are affected by anxiety over debt,” Beata Williams, an Intelligent contributor said to The Supercreator. “And when you look at some of the numbers in the study, where approximately half — 42 percent — of people sometimes have student loans more than 20 years after graduating college. That’s a really long time. And the number of those loans is up to $50,000. That’s a lot of money for your average person to owe.”

And as a result, we find ourselves in a national debate on what to do about it. Intelligent’s study found that people with student debt were most likely to support the government canceling it, led by those who earn more money than those who earn less. For those who oppose student debt cancelation, many said they felt doing so was unfair to those who paid theirs and that it encourages poor personal accountability.

But as I wrote last December, the American Dream has failed millennials. Canceling student debt, while an imperfect solution to some, would return some of the investment that the new economy has been unable to deliver for our generation:

My rationale for student loan forgiveness is personal and unsophisticated. Many millennials, especially first-generation college students like my sister and me, were promised that higher education was fundamental to upward mobility. And that obviously hasn’t been the case. Here is where I copy and paste the facts and figures you’ve already seen before if you read my work: Health care, housing and education are five times more expensive for us than they were for our parents. Steady, stable jobs have become endangered species. Wages have been flat for more than four decades. And white millennials are five times more likely to receive an inheritance than non-white millennials even though millennials of color make up 45 percent of the millennial population. In fact, because college is so expensive, a degree isn’t a wealth generator for Black students. In her piece for The Atlantic, [Annie] Lowery noted research from economist Thomas Shapiro that showed the median white borrower has paid off 94 percent of debt two decades after they enter school; the median Black borrower has paid off just five percent.

President Biden says he lacks the executive authority to cancel everyone’s student loan debt and has punted the issue to Congress to come up with a legislative fix. In the meantime, his administration has extended the pause that began at the outset of the pandemic on student loan repayment, interest and collections through January 2022. “I don’t think that it makes the problem of owing money go away, obviously,” Williams said of the pause. “But I think that maybe it buys people little bit of time to secure a job again, especially if they’ve lost jobs or if they’ve lost their whatever resources they were using to pay off those loans. Maybe it just buys people a little bit of time to kind of try and get back on track with that.”

But the Education Department said that this extension will be its last. And while advocacy groups are raising awareness for initiatives like the campaign to double the Pell Grant to $13,000 to reduce student debt for future students, increase completion rates and stimulate the post-COVID economic recovery, many borrowers were trillions of dollars in collective debt prior to the pandemic. That’s why Sens. Chuck Schumer of New York and Elizabeth Warren and Rep. Ayanna Pressley of Massachusetts continue to call on the president to provide relief:

While this temporary relief is welcome, it doesn’t go far enough. Our broken student loan system continues to exacerbate racial wealth gaps and hold back our entire economy. We continue to call on the administration to use its existing executive authority to cancel $50,000 of student debt. Student debt cancellation is one of the most significant actions that President Biden can take right now to build a more just economy and address racial inequity.

That’s the kind of “cancel culture” I can get behind.

Keep reading with a 7-day free trial

Subscribe to Supercreator to keep reading this post and get 7 days of free access to the full post archives.