Inside the White House legal strategy to defend Biden’s student loan plan

Despite the Supreme Court’s conservative supermajority, sources familiar say the administration is confident in the case it will present on the merits of the program during oral arguments on Tuesday.

👋🏾 Hi, hey, hello! Welcome to Supercreator, your guide to the politicians, power brokers and policies shaping how online creators and their fans work and live in the new economy.

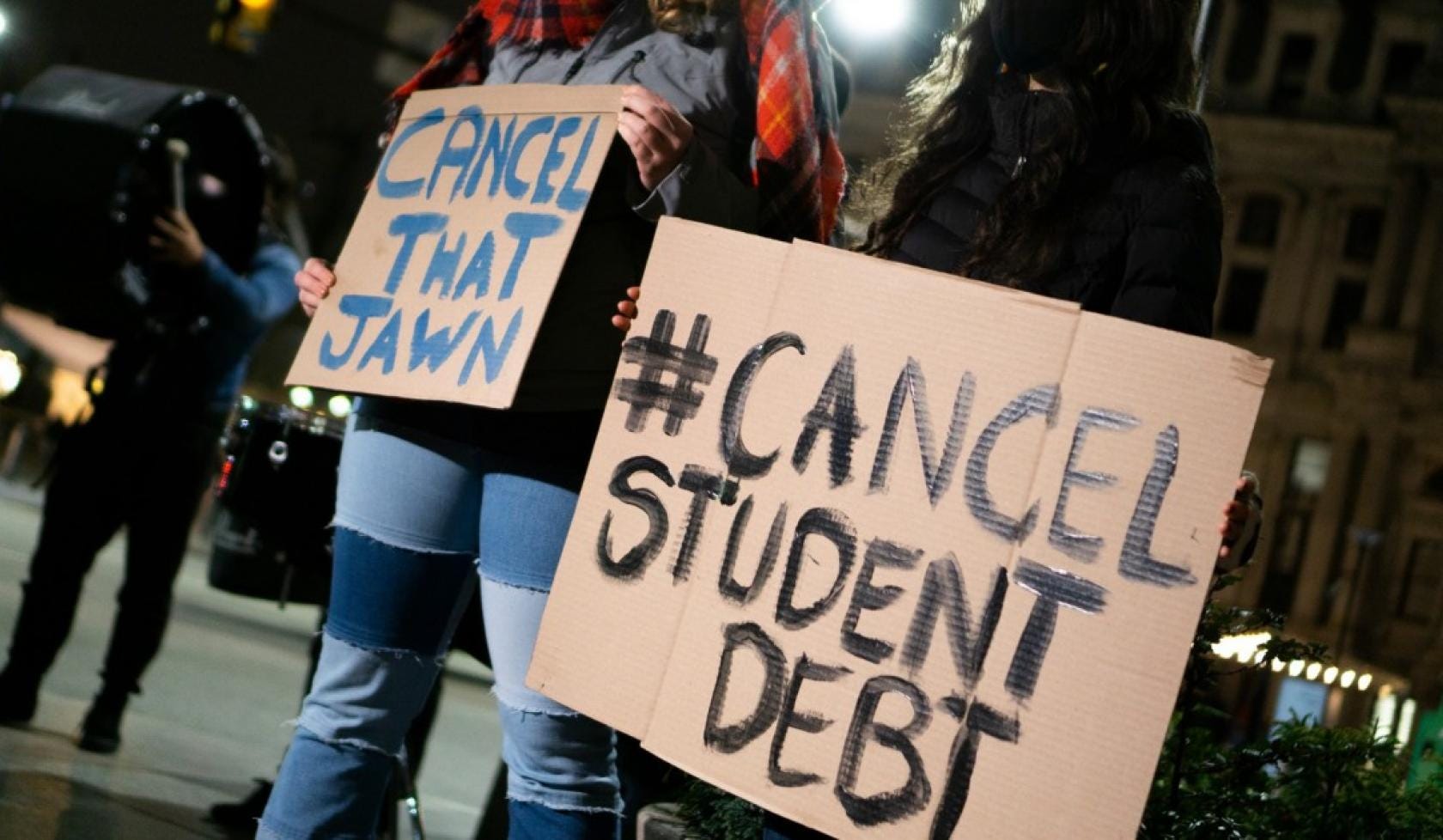

A little after six months after when President Joe Biden announced his plan to cancel $10,000 of student loan debt for borrowers earning up to $125,000 plus an additional $10,000 for Pell Grant recipients, the Supreme Court this morning will hear oral arguments on if his administration can go forward with the program.

People familiar with the administration’s legal strategy have expressed public confidence in Education Secretary Miguel Cardona’s authority to carry out the program. But outside observers fear the court’s conservative supermajority — bolstered by three justices confirmed during the Trump administration — may render even the strongest arguments moot.

Wade Caves, a New York City-based solo creator who spoke to Supercreator last August when Biden announced his plan, said at the time that would be debt free now that his student loans will be canceled and add years back to his financial life and give him a shot at achieving important financial independence goals by his 40th birthday.

In a follow-up interview ahead of the arguments though, Caves said he expects the court to rule against the president’s plan.

“If the Supreme Court uses its weight to bar Biden’s plan by calling it ‘unconstitutional’, then at some stage the federal government will be expecting repayment of my unpaid balance,” he added. “Honoring that would set me back at least six months in terms of savings and make it even more difficult than it already is to set myself up for retirement.”

Democratic Rep. Pramila Jayapal of Washington and chair of the Congressional Progressive Caucus, which called for the president to cancel student loan debt in its executive agenda, said this case is another instance of the right wing’s rules-for-thee-but-not-for-me politics.

“The people who are funding this lawsuit are the wealthiest billionaires who have funding everything else where they’re happy to get subsidies, they’ve taken [Paycheck Protection Program] loans, they’ve had those loans canceled,” she said to Supercreator on Monday night. “And yet they don’t want some poor student to get up to $20,000 of student debt canceled? It’s ridiculous.”

The court will hear two cases being argued together, one of which was brought by top Republican officials in six states including Nebraska and Missouri.

Justice Department lawyers are expected to argue Biden’s plan is clearly authorized by the HEROES Act, the 2003 law the administration says its authority to cancel student loan debt comes from, and gives judges broad discretion to invalidate executive agency actions unless Congress authorized them in legislation.

Cardona determined that a pause on payments wasn't alone sufficient to alleviate the economic effects of the pandemic on borrowers’ ability to repay their loans. The secretary based his decision on analysis that showed a subset of borrowers that would be at a heightened risk of default and delinquency when repayments started again — this rate would exceed the rate that existed prior to the pandemic. Historically, borrowers transitioning back to repayment after periods of forbearance, including after other emergencies, demonstrated a 20-fold risk of delinquency and default after the period of nonpayment ended. Pell Grant recipients experienced even larger increases in default.

But the states claim that the student debt relief plan violates the Constitution’s separation of powers and various provisions of the Administrative Procedure Act, the federal statute that governs the way in which administrative agencies of the federal government of the United States may propose and establish regulations.

They raised several theories of standing, but those familiar with the administration’s legal strategy have focused on two that are related to the Missouri Higher Education Loan Authority, also known as MOHELA, which is a state-created loan servicing corporation.

The first argues that financial harms to MOHELA are also harms to the state because of the connection between the two entities. This theory was originally rejected by the district court when it heard the case and the Eighth Circuit courts of appeals didn’t try to revive it.

In the case’s brief, the states concede that if MOHELA were a private corporation, it would have to sue in its own name to redress its alleged injuries. But they say that because MOHELA was created and is controlled by the state, the state can sue on its behalf.

The Justice Department said in its reply brief that Missouri is a separate legal entity that has its own right to sue and be sued. And sources familiar with the administration’s legal strategy added that MOHELA has publicly stated that it was uninvolved in the decision to challenge the student debt relief plan and expressed its independence from the state.

For its second theory, plaintiffs argue that because MOHELA owes Missouri money and the student debt relief plan’s effects on MOHELA could cause it to miss those payments because it reduces the number of loans in MOHELA’s portfolio reducing its servicing fees. The result, the states claim, is that MOHELA cause it to default on these state law obligations it has to pay money to the state treasury.

The Justice Department is expected to swat this argument away because it says MOHELA also earns fees — or would earn fees — for processing discharges under the plan. Most importantly, according to sources: the states don’t allege or show that the amount MOHELA, which hasn’t paid on those state obligations since 2008, would lose in servicing fees exceeds the amount it would earn from processing the discharges. The plaintiffs also haven’t shown that if MOHELA defaulted, it would be because of the plan and not other circumstances.

In another case, two borrowers — one of whom was ineligible for any debt cancelation and the other one who qualified for $10,000 in cancelation — claimed the Education Department should have put the student debt relief plan out for notice and comment under the APA so that they could have advocated for a broader program that would have given them relief.

Sources familiar with the administration’s legal strategy say the borrowers don’t have standing because the HEROES Act, the 2003 law that the administration says gives it authority to cancel student debt, exempts the Education Secretary from notice and comment procedures. Cardona cannot give the plaintiffs the relief they’re seeking even if the argument is true because it would strike down the whole plan so no one would benefit.

The principle the plaintiffs have based their claims on is what’s known as the major questions doctrine that compels a judicial review of actions by executive agencies that act outside the authority a statute gives them. But the Justice Department argued in its brief to the court that the doctrine doesn’t apply in this case because the HEROES Act specifically intended to allow the Education Secretary to respond to a crisis by updating the requirements of a government benefit program at the heart of his authority.

There are a few vulnerabilities to the government’s case that could ultimately serve as self-inflicted wounds.

First, the White House announced at the end of last month that it would end COVID emergency declarations on May 11, which could throw a wrench in the administration’s argument. But sources familiar say the HEROES Act requires that Cardona’s plan aims at the economic consequences of the emergency, which they say persist after it ends.

And although some advocates for student loan debt cancelation and legal experts wonder why the White House chose to fight this up to the Supreme Court and risk a ruling that could hamstring other policies and programs, people familiar with the administration’s legal strategy said they aren’t writing off the court solely off its current composition or any previous rulings and expect the justices to seriously consider the argument and rule on the merits.

President Biden will be in Virginia this afternoon to contrast his economic plan with the House Republican agenda and has used every public speaking opportunity to wax about the strength of the economy that has created 12 million jobs and experienced historically low unemployment during the first two years of his administration.

Sources familiar though believe the strength of the economy is a distraction from the fact that the president’s plan is targeted to a specific segment of the population with a likelihood of greater delinquency and default coming out of the pause based on Cardona’s analysis of the groups who would be worse off from the pandemic not on the overall health of the economy.

Finally, President Biden himself and former House Speaker Nancy Pelosi both previously said they didn’t believe he could cancel student loan debt through executive authority. The government is expected to argue that these were political statements though, not legal arguments, that don't speak to the strength of the arguments.

It’s worth noting that the Biden administration finds itself in this quagmire because the votes aren’t there in Congress to cancel student loan debt through legislation, which obviously wouldn’t guarantee it survived a court challenge but it undeniably more durable than an executive order.

“I could fill a book with congressional disappointments, and this would be but one subplot in a wider narrative of Congress doing too little to lessen the gap between extremes of outcome for the American people.”

Rep. Jayapal, the Progressive Caucus chair, told Supercreator on Monday night that she shared this frustration because big things don’t always happen immediately in Congress and happen too slowly for the people who need them now.

But the Overton window on so many progressive policies from climate to marriage equality to student loan debt relief has rapidly shifted in recent years, Jayapal added there’s still reason for optimism no matter the court’s decision.

“If we can just hold on, hopefully, the Supreme Court will be with us. I'm not ready to concede that yet,” she said. “But if for some reason they're not then we keep up the pressure pushing to get this done, either through other administrative actions or legislatively. We have gotten so much done that nobody thought was possible. So I think we just can’t give up.”